Passive revenue is unearned revenue usually derived from investments. That’s fairly easy, so there needs to be extra to it, proper?

Let’s dive in and discover what passive revenue is, if passive revenue is definitely actual, the various kinds of passive revenue, and extra.

We’ll even get into a number of the technical elements of passive revenue—taxes and actual world examples.

Able to find out about passive revenue? Let’s dive in.

What Is Passive Earnings

As we mentioned earlier, within the broadest sense, passive revenue is unearned revenue. Principally, you might have revenue you’re employed for (at a job, enterprise, facet hustle), and you’ve got revenue that you just don’t work for—passive revenue.

Passive revenue is at all times derived from an funding.

There are two methods to create passive revenue, you may make investments your time or your cash. Most passive revenue alternatives require a mix of each.

For instance, you may make investments your time in making a music or {photograph}, which you’ll promote and earn royalties on.

Or, you probably have cash, you should buy a inventory or actual property and obtain revenue from it.

In a mix method, you should buy a fixer-upper property, make investments your time fixing it up, after which lease it out to obtain increased passive revenue. For those who have been doing this undertaking to flip the property; I’d really argue that’s not passive revenue. However in case you’re boosting your lease by sweat fairness, that’s passive revenue.

What Passive Earnings Is Not

The important thing factor to recollect is what passive revenue shouldn’t be. Passive revenue shouldn’t be revenue derived straight from work resembling:

These examples above are lively revenue.

Is Passive Earnings Actual?

It doesn’t sound like passive revenue is really passive, does it? It makes you marvel if passive revenue is actual.

Passive revenue is actual however it’s a must to do one thing upfront to appreciate the revenue later. That one thing both entails your time or cash.

The purpose is to do work or use your cash at one level and benefit from the rewards of that passively (i.e. by not having to do extra work or make investments extra money) over time.

Totally different Varieties Of Passive Earnings

Now that we perceive a number of the fundamentals of passive revenue, what are the various kinds of passive revenue?

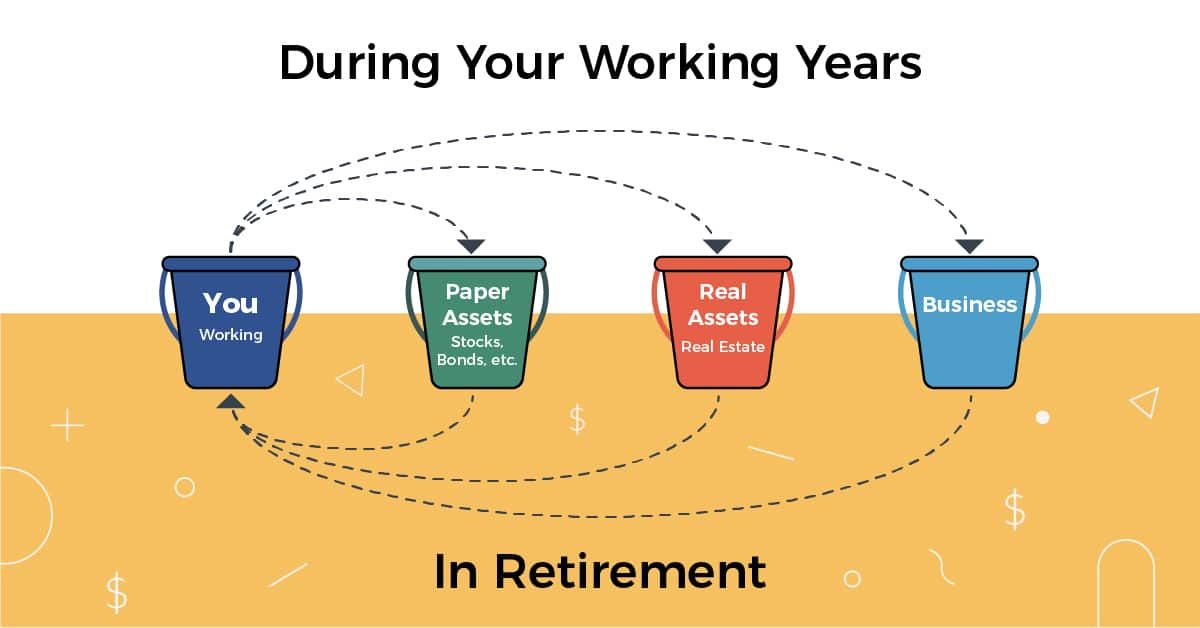

I like to think about it utilizing our buckets of property method:

- You (lively revenue)

- Paper Belongings (usually passive revenue)

- Actual Property property (may very well be lively or passive revenue)

- Enterprise Belongings (may very well be lively or passive revenue)

Let’s begin with paper property as these are the sorts of passive revenue most individuals could be accustomed to: shares, bonds, mutual funds, financial savings accounts, and extra.

These are investments that require an upfront financial funding, however you may earn passive revenue from proudly owning them. No future work is de facto required (besides checking your accounts).

Actual property property may very well be lively or passive. For instance, in case you spend money on a REIT, you don’t do something besides benefit from the passive revenue supplied. Nevertheless, in case you personal your individual duplex, it may very well be a mix of lively and passive revenue.

Enterprise property are comparable. For those who’re working in your online business, it’s not passive. However in case you’re merely an investor in one other enterprise, that may very well be passive.

Execs And Cons Of Passive Earnings

Whereas passive revenue is often seen as a constructive, there are execs and cons.

Execs

- You possibly can earn revenue with none work!

- You possibly can acquire additional money circulation

- Extra monetary freedom, together with early retirement

Cons

- Some types of passive revenue could also be less-liquid, that means you may simply entry your principal (it’s locked up)

- Relying on what you spend money on, your return is probably not nice

- Utilizing your time (slightly than cash) is unpredictable

Why Everybody Ought to Construct Passive Earnings Streams

On the finish of the day, everybody needs to be constructing passive revenue to create a number of revenue streams.

Why? The perfect particular person to handle your funds is you.

You don’t wish to be depending on an employer or a pension fund to your revenue. You need to have the ability to management your individual monetary future, and also you try this by investing and constructing wealth, which in flip will generate passive revenue so that you can reside off of.

Plus, sooner or later, you gained’t be capable of work (both retirement and even one thing surprising like an accident). You need to have the ability to present for your loved ones with an revenue stream, even in case you can’t go to a day job to earn it.

How A lot Can You Earn?

So, how a lot are you able to earn? It relies upon. The important thing issue that it is dependent upon is cash. In terms of utilizing your time, a little bit luck is concerned (like having a music go viral which you can earn royalties on).

For a fundamental calculation, let’s discuss passive revenue from a financial savings account. You possibly can earn curiosity in your financial savings. The perfect accounts pay 4% in curiosity per yr proper now. Meaning you may earn $400 for each $10,000 you might have saved. And that’s actually passive revenue.

A cool function about passive revenue is that it often additionally sees compound development. What which means is that sooner or later, you earn revenue in your previous curiosity.

Going again to our financial savings account instance, in yr two, assuming you didn’t add any cash, you’d now have $10,400. And incomes 4% on that’s $416. So that you earned $16 greater than the prior yr.

That is highly effective. Bear in mind our instance from “would you slightly have a penny that doubled every day or $1,000,000?” The penny that doubles is far more beneficial!

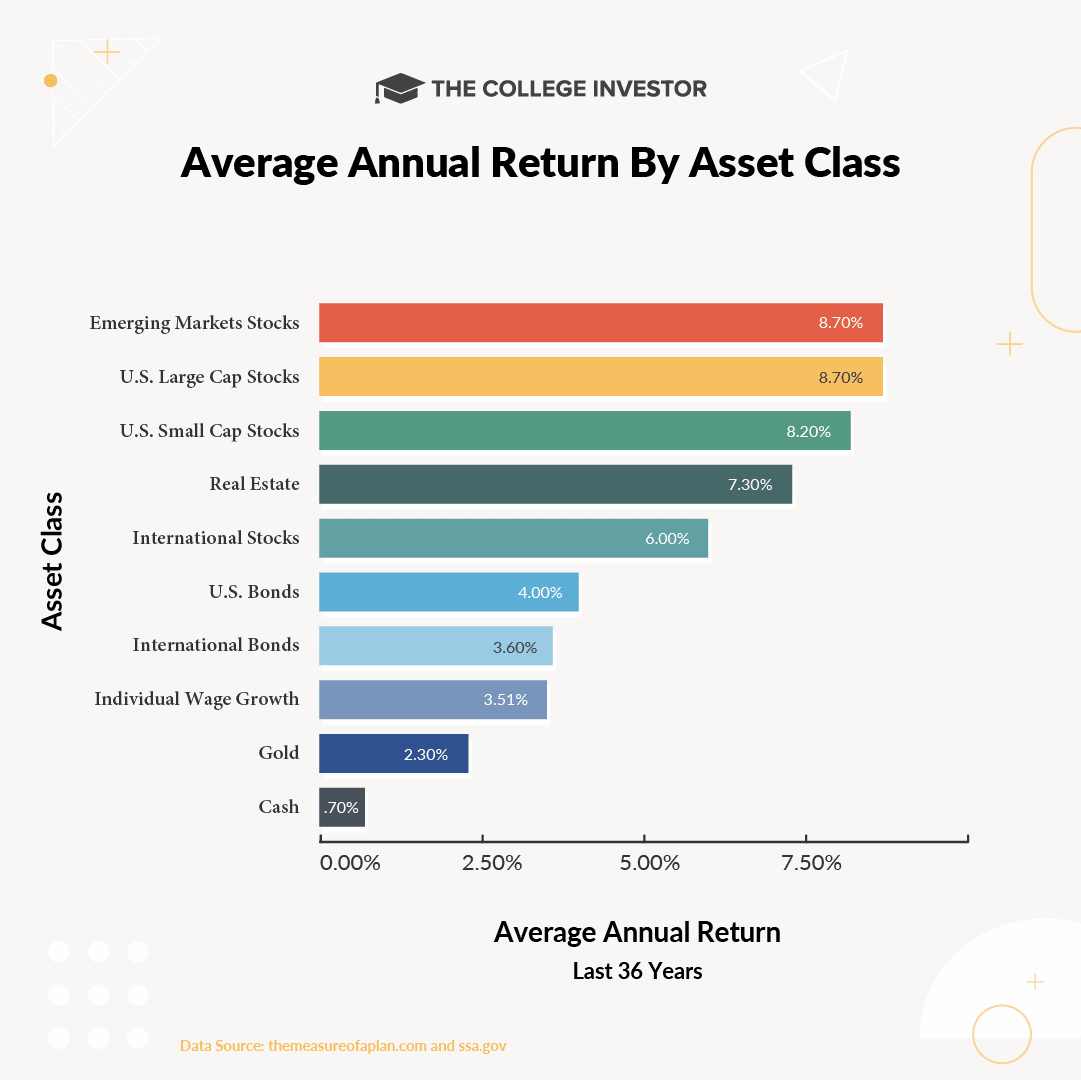

And what in case you make investments as a substitute of simply saved? You possibly can earn much more (and see your cash develop much more). See this chart to the typical return by asset class:

Is Passive Earnings Taxable?

What about taxes? Everybody likes to speak about taxes in terms of cash. And there are actually dangerous takes on the market—such as you shouldn’t earn extra since you pay extra in taxes! Don’t hearken to that dangerous recommendation.

Sure, the cash you earn as passive revenue is probably taxable. However that’s not a nasty factor—you’re incomes extra money!

I’d slightly earn an additional $100 realizing I solely preserve $80, than not doing something in any respect and never having that $80.

Passive revenue is taxed based mostly on what sort of revenue it’s:

- Curiosity and dividend revenue is often taxed based mostly on these capital positive aspects charges

- Capital positive aspects are taxed as capital positive aspects (resembling from mutual funds)

- Actual property revenue and enterprise revenue are usually taxed at your strange revenue tax price

- Collectibles get a particular tax price in case you’re concerned in these

For those who’re confused on whether or not your passive revenue is taxable, communicate to a tax skilled!

Most Fashionable Passive Earnings Examples

We now have a full information to the preferred passive revenue concepts right here >>

Right here’s a little bit sampling of those concepts:

Financial savings Account

Proper now, you may earn upwards of 4% in a financial savings account, and much more in a Certificates of Deposit.

Shares

Shares pay dividends, and you will get began investing in shares for as little as $10 at most main brokerage corporations. Plus, it’s commission-free to spend money on shares, mutual funds, and ETFs and most locations.

Actual Property

There are loads of methods to spend money on actual property, however from a passive funding perspective, a REIT or a fund is the very best.

Ultimate Ideas

Passive revenue might look like a fantasy, but it surely’s actual and anybody can construct it. The hot button is to start out early, even in case you’re beginning very small. Your investments will develop over time, producing extra passive revenue for you, which in flip will develop extra.

So, even in case you solely have $10, get began with passive revenue!

Passive Earnings FAQ

Let’s break down some widespread passive revenue questions!

What’s passive revenue?

Passive revenue is unearned revenue usually derived from investments.

What’s an instance of passive revenue?

The most typical instance of passive revenue is a financial savings account. You merely deposit your cash into the account, and your earn curiosity for doing no work. That curiosity could be thought-about passive revenue.

Can you reside off passive revenue?

Sure! In reality, that is the purpose of retirement. You may have sufficient saved and invested that you just generate sufficient revenue to reside off of.

What are three types of passive revenue?

There are numerous types of passive revenue – which both require an upfront financial funding or upfront time funding. It can save you cash, make investments cash, or make investments your time to create one thing which you can promote sooner or later passively.

How are you going to begin constructing passive revenue?

You possibly can commit your time or cash (or each). If in case you have a little bit more money in your price range, begin saving and investing it. If in case you have a little bit additional time, begin facet hustling to create one thing which you can promote to earn cash.