Ratio buying and selling the earnings

Everybody is aware of what a ratio commerce is true? A ratio will be discovered in lots of shapes, kinds and instructions, the SO beloved Hedged Straddle is a ratio whereby a bigger variety of lengthy positions are offset (partially) with quick positions which might be nearer in time. Its a extra refined model of the common-or-garden promote 1 quick ITM and purchase 2 lengthy ITM (whether or not with calls and places) for zero money outlay (or perhaps a minor money+ or money -) besides margin.

This text is my very own reflection of the usage of this selection technique however impressed partially by what I learnt right here on SO. I give it to you for criticism and ideas – so agree or disagree with me, I sit up for the talk. The basic commerce described above works each for calls and for places, within the article I caught to requires illustrative functions but it surely works simply as properly with places.

Now you could ask why would you wish to do a ratio commerce forward of earnings?

- there’s a massive portion of shares which is able to run-up in value forward of earnings;

- as we all know from the SO lengthy calendar, IV will rise forward of the earnings announcement. An choice that’s ITM is much less affected by IV rising than one that’s ATM or OTM and so the mere rise in IV advantages the commerce;

-

black swan safety – if the market have been to tank actually badly, the inventory would find yourself under the quick strike (if calls) and the entire commerce could be a secure wash.

To place it less complicated, the ratio commerce forward of earnings is a method to be out there with out risking your shirt – your losses are usually mitigated if the commerce is managed properly. Anybody who has purchased lengthy calls earlier than earnings could have recognized the enjoyment of a 100%+ rise however after all additionally the bust of shedding 100% when the market is antagonistic to you. Definitely in case you are lengthy and proper on path, nothing beats the straightforward lengthy place nevertheless the ratio commerce permits you to try this a number of occasions with out shedding your shirt in case you are improper. And you’ll be improper often even for those who comply with the method I describe under, the trick is to attenuate the occasions you’re improper and the dimensions of the loss whereas you rake within the income if you get it proper.

Now already a few of you could be skeptical concerning the IV impact however consider me it’s large, under I’ll use AZO for instance. Why AZO? Properly its a inventory that appears to be rise earlier than earnings however its not an ideal instance and since its inventory value is excessive the margin requirement makes it considerably much less sensible to execute. Its an instance and never meant to be adopted, however it’s a actual reside one, in any sequence of earnings per week there are by no means fewer than half a dozen potential candidates. Anyway, right here is the schematic of an AZO 1:2 ratio primarily based on 80 (quick) and 60 (lengthy) delta calls 15 March (i.e. after earnings that are unconfirmed for 29-Feb or 5-Mar).

Now I do know that the IV of this place will rise to 112% the day earlier than earnings so if I have been to enter that IV in the present day you’d see the place achieve 10K instantly:

That is fairly spectacular eh? In fact its probably not truthful as a result of that’s the IV worth proper earlier than earnings so lets convey the date ahead to 1st of March – form of a guess of the suitable date seeing we’re not certain what the earnings date truly is.

See how cool that’s? Even when the inventory wouldn’t budge, theoretically beneath these parameters our place would have GAINED in worth. Notice that actuality tends to be extra fractious than the juicy look of those charts however the impact actually is there. The rise in IV is a buffer in opposition to theta losses and in the meantime we may make a bundle if the inventory moved in the suitable path.

What do I would like to decide on my commerce?

Once we are searching for a inventory appropriate to commerce we have to make clear the next questions:

- Is that this a inventory that rises earlier than earnings?

- When ought to I enter and when ought to I exit the place?

- What are the best deltas of the quick/lengthy place to maximise income (and what’s that revenue goal)?

- What ratio ought to I exploit? (that is a lot associated to the earlier query as we are going to see)

- What is going to the IV be on the deliberate finish time of my commerce?

- What inventory value would permit me to break-even on the deliberate end-date of the commerce and what inventory value would get me (theoretically) to the deliberate revenue?

If we’ve got the reply to all these questions we are able to make a buying and selling plan and if on the day every part appears good then execute it and comply with the plan. It additionally permits us to have a suggestion to resolve to take the winnings or minimize our losses as a result of we’ve got set an important parameters. So lets take these questions one after the other, utilizing the instruments which might be generally utilized by everybody on SO – true a few of these are paying instruments however I feel they’re properly value it. A bit hardwork with charting software program can most likely additionally get you to many of the outcomes with out the necessity to use paying companies.

Which inventory rise earlier than earnings?

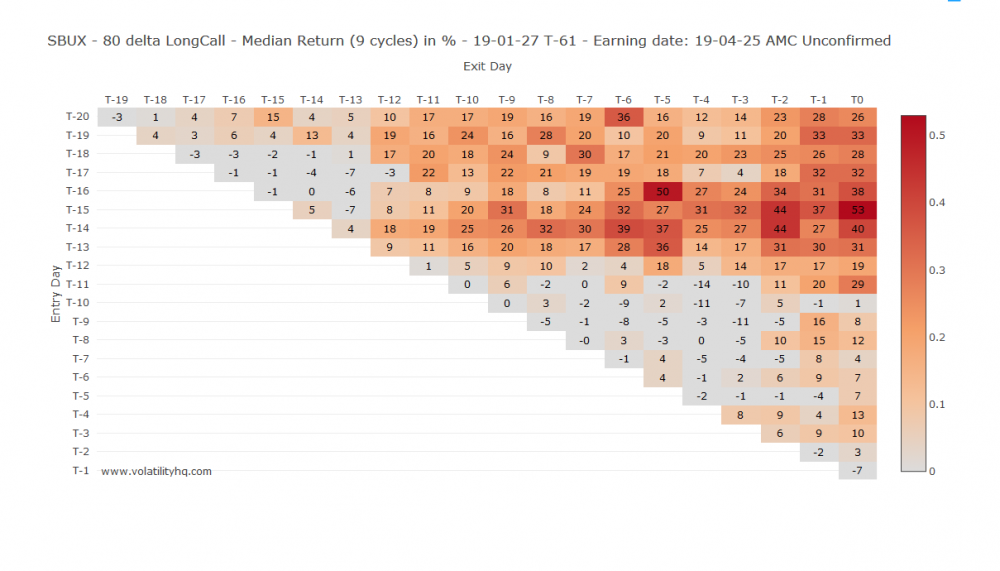

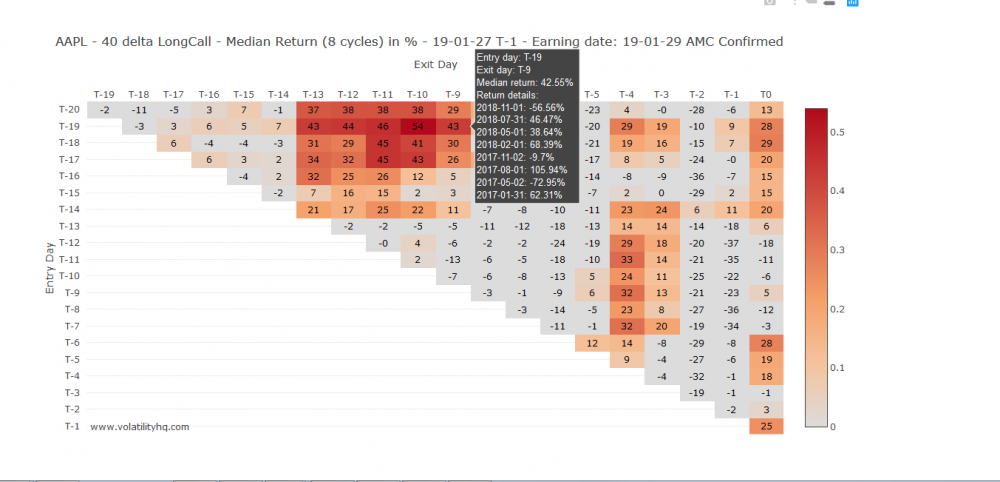

Properly you could possibly simply take a look at shares and test again earlier incomes dates and discover them – nevertheless due to SO I’ve discovered VolHQ actually helpful right here – they’ve a return scanner matrix. To make use of one instance that has labored very properly up to now and that I’ve traded efficiently persistently: SBUX. See the warmth map which have:

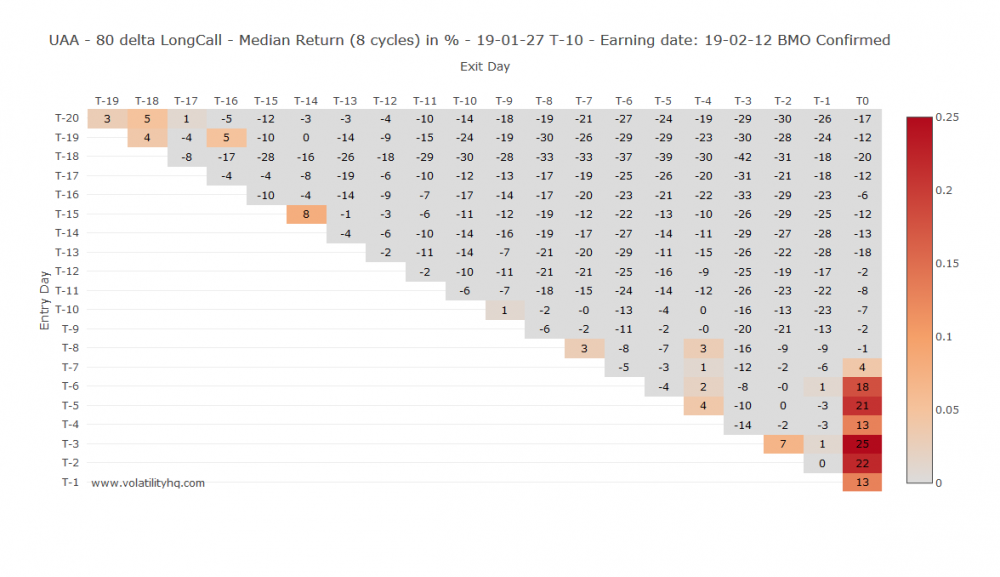

That is the kind of warmth map you wish to see – as you possibly can see there are a few crossings the place there are substantial income. I all the time begin out trying on the 80D one as a result of I must have a inventory that truly rises and the 80D choice is fairly near the precise inventory worth. To indicate you the reverse sort chart see UAA:

UAA will not be an excellent candidate for this technique the few pink bits however, in actual fact UAA is an effective candidate for a ratio put commerce – however that is one other story.

When ought to I enter and exit the place?

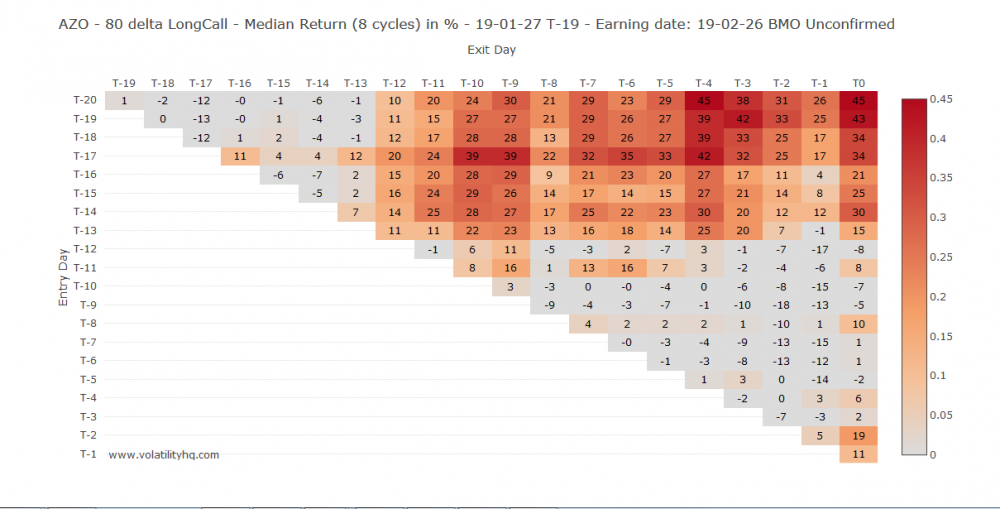

Now like I stated we’d take a look at AZO – the 80 Delta Return matrix of AZO appears like this:

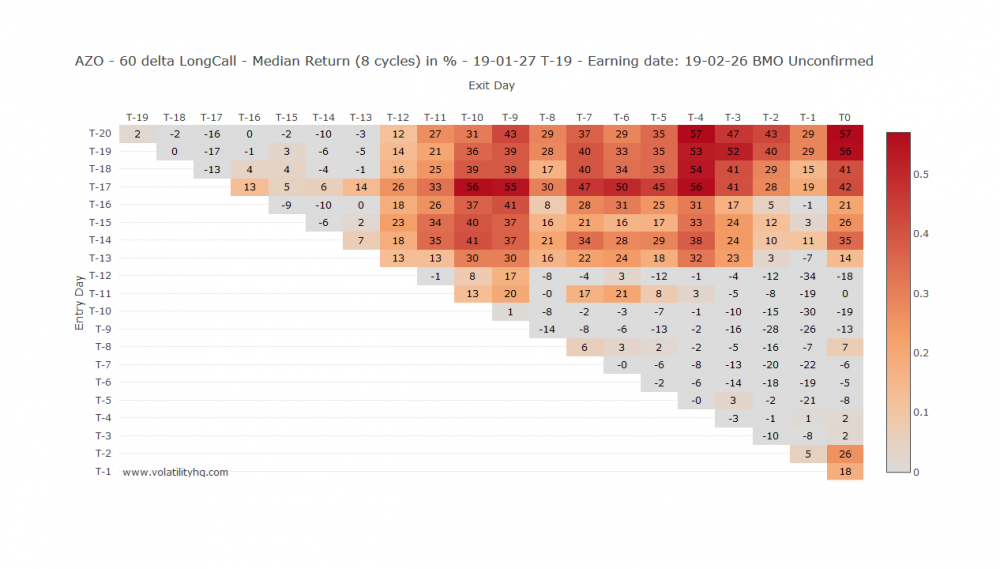

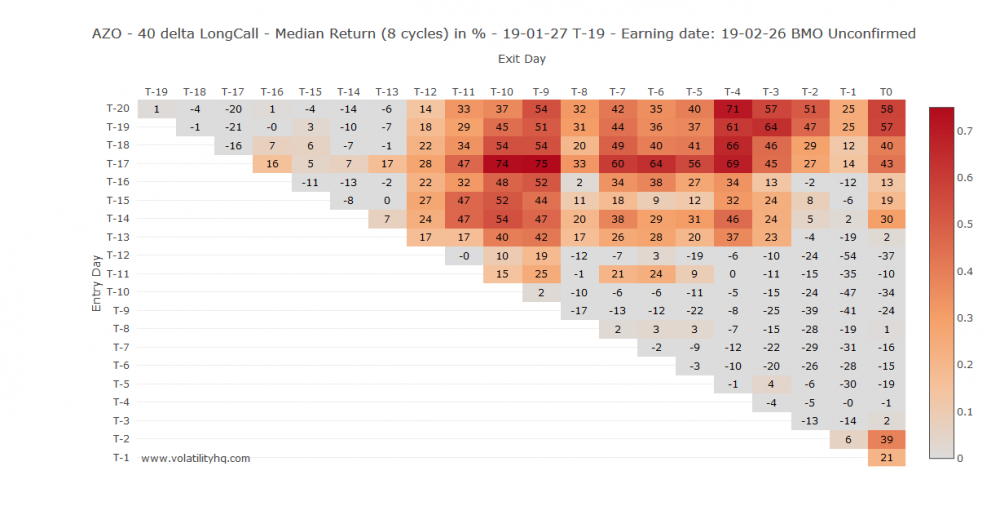

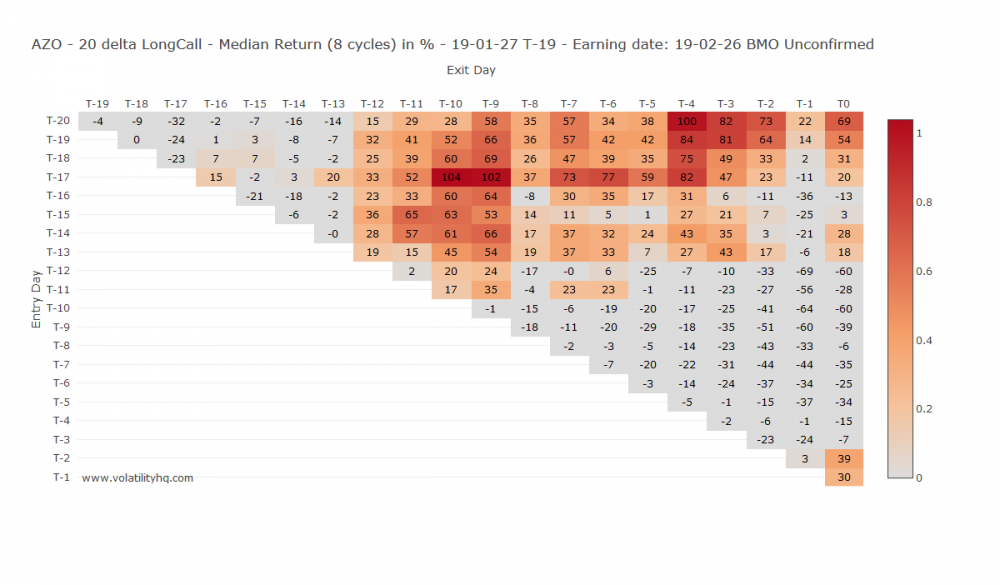

That is truly fairly good – so we should always take a look at the 60,40 and 20 D lengthy name returns as properly:

Now instantly you possibly can see a kind of risk right here – someplace between T-20 /T-16 opening and shutting between T-12/T-8 appears to have essentially the most constant heat areas within the warmth map. In reality if you look intimately there are most likely a number of alternatives however the highest returns for all of the choices no matter delta seems to be T-17 open and shut T-9 (give or take a day relying on the choice). Another variants are conceivable and value taking a look at – however this early one has the extra consolation that we’ve got time to adapt if essential earlier than earnings hit us. Meaning presuming the earnings are introduced someplace in between the 2 dates presently mooted that we should always open on or round eighth of February and shut the commerce on or across the 18th of February, In any case we should not maintain the place too lengthy as a result of it appears to worsen thereafter.

What are the best deltas for the choices for use within the ratio?

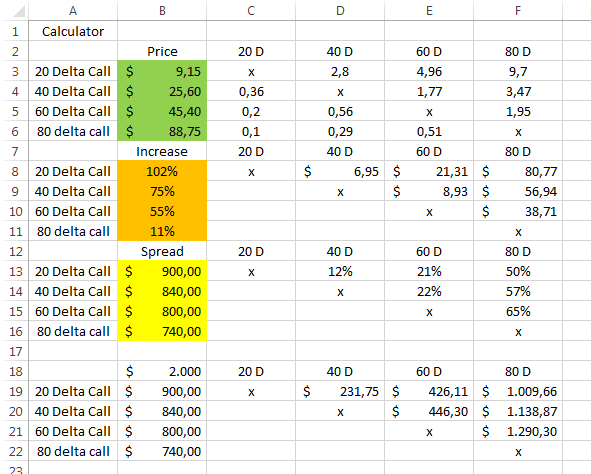

Right here is the place I feel I can declare some originality – for an extended whereas I thought a one strike ITM, one strike OTM was the very best method or that presumably to be efficient the ratio needed to be 1:3 – however in actual fact nothing is farther from the reality. It depends upon the inventory, the IV and the timing – there isn’t any onerous and quick rule although it’s considerably extra frequent to have greater delta ratios being efficient. This calculation is sort of complicated as a result of you must evaluate like for like. Virtually talking the comparability should take variations of capital outlay because of margin into consideration in addition to the opposite parameters of choice pricing. I made a spreadsheet for this and it’s good to fill the highlighted sections in your self to get outcomes (all different components are crammed mechanically):

You’ll want to decide the inventory value akin to the 80/60/409/20 delta calls respectively for the choice sequence ending soonest after earnings announcement. On this case because it was unsure I selected the common third Friday expiry as a result of this sequence could be extra liquid and related by way of choice pricing. The related strike costs usually are not precisely corresponding however shut sufficient for my functions – shares with decrease costs the gaps have a tendency be linear 5$ from delta to delta, however not right here as they’re 740/800/840/900$ respectively for the 80/60/40/20 Delta name sequence. I enter these within the yellow highlighted part.

The orange part has the return as per volatilityHQ return matrix primarily based on our timings above. The inexperienced part is solely final Friday’s mid-price of the choices in query. To find out which is the best delta mixture with the above components we take a look at the third and fourth set of desk marked SPREAD and $2000 respectively. They’re in actual fact the identical besides the primary one provides a return in % and different the return primarily based on a hypothetical 2000$ funding for every of the positions. On this case the 80 delta quick and 60 delta lengthy seems to be the winner as has the best return of 65%.

What ratio ought to I exploit?

Properly my excel sheet tells us that within the first part of the desk marked PRICE – if we take a look at the 60 DELTA Name and match that in opposition to the column of the 80 Delta name we discover a 2:1 ratio to be acceptable.

Nice you’ll say, can I commerce now?

Nope. There are a number of extra issues to do and some extra caveats to handle earlier than you press that commerce button.

What is going to the IV be on the finish of the commerce?

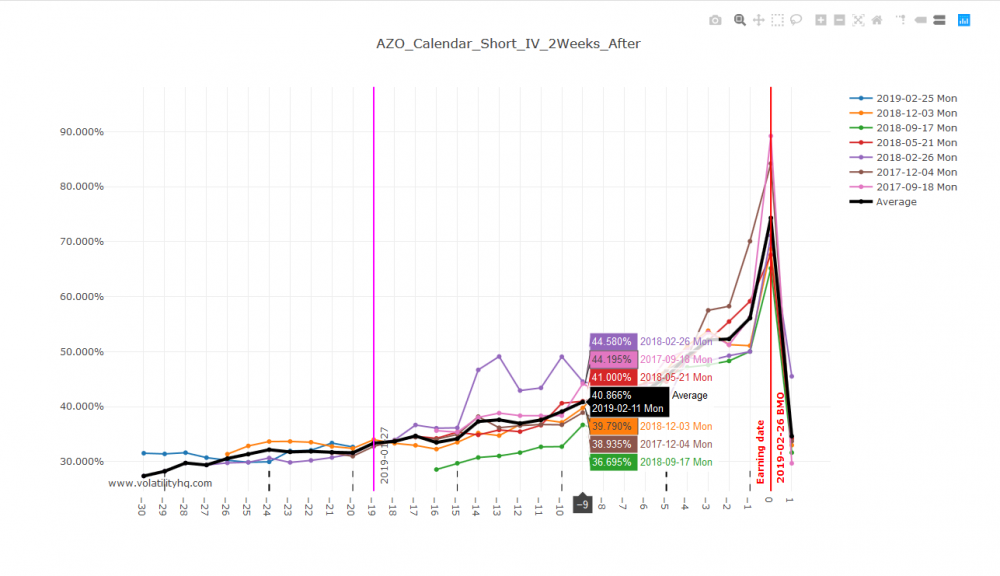

For this I return once more to volatility HQ and let it run its regular calendar operate. That is helpful anyway as a result of you possibly can test on the similar time whether or not the inventory is appropriate for a calendar. Nonetheless I’m trying on the third chart down on the calendar plots from vol.HQ:

So at T-9 – our proposed exit date for the commerce IV could be ca. 41%, this we are able to now enter into our choice valuation as we’ve got entry costs (admittedly primarily based on in the present day’s choice costs) and we all know our exit date and the IV at the moment.

What’s my breakeven/goal revenue inventory value at exit day?

It seems our break-even value is in the present day’s inventory value – that is fairly cool – even when nothing occurs we must be okay(ish), the projection is for the exit date at T-9:

When it comes to our revenue – let’s imagine we goal at 50% – for causes I clarify within the caveats under its higher to be conservative and seize the cash and run when you possibly can. This might already be an awesome success – on this case the commerce would have required 6K+ margin so I might search for 3K revenue. Because it seems that’s across the 871.50$ mark for AZO. Now you would possibly say that’s fairly a climb however it’s in actual fact solely +7% in comparison with in the present day – by no means out of the query and properly inside earlier iterations of this shares earnings run-ups.

Okay now we’ve got a plan:

- we plan to enter the commerce on eighth of February on 2:1 ratio of the 740/800$ 15-Mar name choices;

- we plan to exit on the newest on 18th of February

- if at any time the inventory ought to hit 870$+ we liquidate as a result of that may be our finish sport if it was the ultimate day of the commerce as properly;

-

if throughout the commerce the choice threatens to stay under 814$ we would have to chop our losses. In reality for this explicit ratio it doesnt look too problematic because the cushion of IV could be very massive.

Houston we would have an issue? (caveats)

Okay so what are the downsides and difficult issues concerning this commerce?

-

The black swan safety is a little bit of a false safety. Many individuals suppose that the commerce might be okay if the inventory tanks as a result of in that case at expiry we’d have the small credit score (or debit) left over from the ratio. Nonetheless this commerce should NOT BE HELD THROUGH EARNINGS – due to this fact the IV will stay elevated and if the inventory tanked you could discover that the market costs your choice properly under the value on the finish. Sure – WELL BELOW – even when the inventory is methods beneath the quick choice. This can be a actual ache as a result of until you are taking the commerce via earnings as a result of the market tanked so massively it could not presumably pop up – it may simply inconveniently rise to precisely your worst level (lengthy strike). In that case you’ve gotten the max. theoretical loss and no time left to adapt the place. There is no such thing as a free lunch – the commerce can lose cash – definitely a lot lower than an outright lengthy however often I’ve misplaced as a lot as 50% of the max. theoretical loss;

-

Discovering the suitable inventory will not be really easy and the heatmaps on vol. hQ are averages – it is rather necessary to hover your mouse over the crossing of entry date v. exit date and see what the typical is predicated on:

-

Liquidity stays necessary – you can’t do that with shares with very large spreads. The ratio is extra forgiving than the calendar in that there isn’t any restrict to do that on low worth shares however you cant have a spreads widening an excessive amount of as it’s good to purchase and promote twice;

-

This prep work that you just do – you must repeat it throughout earlier than you truly decide to the commerce. Between then and now among the parameters (not all) could have modified and due to this fact be ready to have an extended onerous look earlier than urgent that COMMIT button;

-

You need to watch these trades and adapt typically – don’t forget to double test precise earnings dates – that is one motive why even very constant however time slender profitable previous expertise will not be sufficient. You might simply be a number of days off and like I stated no matter you do dont take the commerce via earnings, the IV crush publish earnings will wipe out even worthwhile positions pre-earnings that profit from a post-earnings transfer of their path. I’m NOT KIDDING – I’ve misplaced cash on Netflix going up 30$ over my lengthy strike on a ratio commerce held via earnings.

Okay you scared me – any soothing phrases?

No system is ideal and I’m to listen to suggestions. Nonetheless my expertise has been superb up to now and it’s bettering particularly as I’ve now nailed down higher what kind of ratio to enter for each inventory I am going on. Together with the intervals once I was nonetheless discovering my method (which included some clunkers I can let you know), I’ve roughly the next batting ratio:

- worthwhile on course (or close to sufficient/over – all the time greater than 10% on common 18%): 26

- on or round 0% (contains +5/-5% however most often simply +1/-1%): 18

- losers on common about -20%: 10

Since I began choosing the deltas extra fastidiously my hit ratio has improved with no actual losers in any respect however the pattern measurement is simply too small for my part. Proper now I’m buying and selling blocks of round 2-3K in worth although I’ve gone over 6K from time to time. I feel they’re okay for the retail investor – it could be fairly onerous to open a 100 calls and quick a 100 calls in most shares which might be appropriate. Usually although for decrease volumes you get good costs – institutionals in actual fact have unhealthy costs as a result of they purchase a lot quantity they affect the market value immediately.

Would you wish to study in actual time learn how to determine these alternatives and commerce them? Click on the button under to get began!

Be a part of SteadyOptions Now!

Associated articles: