Investing is not only for the large leagues. For solopreneurs and smaller entrepreneurs, it is a discipline ripe with alternative, extending properly past the normal realms of shares and bonds. Studying the way to put money into companies is completely inside attain with the appearance of recent alternatives paired with highly effective expertise.

Opposite to standard enterprise actuality, investing is not simply doable—it is a strategic transfer. Smaller gamers can maneuver via market niches extra swiftly, uncovering precious alternatives that bigger buyers may miss.

I’ve researched, vetted, and curated a listing of seven funding concepts that align with the nimble nature of smaller-scale entrepreneurship. And chances are you’ll be stunned to be taught that not all of those choices require a considerable sum of capital.

Let’s dive in and discover the correct funding possibility for you.

7 Enterprise Funding Concepts For Entrepreneurs

Earlier than exploring the seven enterprise funding concepts, let’s contact on the 2 main varieties of investments: fairness and debt.

- Fairness Investments: Contain buying a stake in an organization, thereby proudly owning part of the enterprise and sometimes having a say in its operations.

- Debt Investments: Buyers lend cash to a enterprise in alternate for curiosity funds, with the principal quantity usually repaid later.

The next concepts cowl each varieties of investments. You’ll be able to determine which strategy aligns greatest based mostly in your monetary targets and danger tolerance.

1. Fee-Primarily based Investments

Fee-based investments provide a gateway for entrepreneurs to earn by selling different corporations’ services or products. As an alternative of placing any fairness into an organization, you obtain a share of gross sales you’ve got generated by showcasing or distributing on behalf of the corporate.

This low-barrier entry technique requires minimal upfront funding, making it engaging for a lot of. You possibly can earn commissions on the next buildings:

- Affiliate Advertising: Earn a fee for advertising and marketing one other firm’s merchandise in your platform.

- Dropshipping: Brainstorm dropshipping enterprise concepts and promote merchandise in your web site or a market {that a} third social gathering fulfills, incomes a margin on the sale.

There are many nice programs which can be each reasonably priced and complete to get began with these strategies. I’ve invested within the Authority Website System, which teaches entrepreneurs the way to construct affiliate relationships and promote companies and merchandise on their web sites. I respect that the corporate recurrently updates the courseware, retaining the whole lot compliant down the road.

For these fascinated with dropshipping, the favored Udemy program Construct a Dropshipping Empire From Scratch might help you get began on this area.

2. Peer-to-Peer Lending

Peer-to-peer (P2P) lending connects entrepreneurs with small companies or people needing loans via platforms like Honeycomb and Kiva. Think about lending to a burgeoning espresso store that wants funding to open a second location. Your return comes as curiosity funds, providing a monetary profit and the enjoyment of seeing a neighborhood enterprise thrive.

P2P platforms usually permit beginning investments from $25 to $50, enabling straightforward danger unfold by letting you put money into varied small loans.

Your most funding varies with every platform’s guidelines, authorized limits, and whether or not you are an accredited investor. Non-accredited buyers face caps based mostly on revenue or wealth, whereas accredited buyers usually have larger limits.

There’s a variety of upside to this potential funding alternative:

- Impression small companies and native economies.

- Diversify your funding portfolio past conventional shares and bonds.

- Entry to a broader vary of buyers, together with those that usually are not accredited buyers.

Whereas P2P lending will be rewarding by supporting the expansion of small companies and providing doubtlessly engaging returns, it additionally carries the danger of mortgage default and the problem of predicting variable curiosity funds. Decide your danger stage earlier than getting began with loans.

3. Purchase and Maintain Shares and Index Funds

Shopping for and holding shares and index funds is a key technique for long-term progress. This technique opens the market to enterprise homeowners for substantial potential returns, championing the facility of persistence and time. It is probably the greatest passive revenue concepts for compounding curiosity to boost your portfolio’s worth considerably.

Are you interested by the way to put money into companies via the inventory market? Listed here are three most important approaches:

- Direct Inventory Buy: Choose particular person shares to purchase straight.

- Index Funds: Put money into a broad market section for diversification.

- Dividend Shares: Select shares that pay dividends for normal revenue.

This technique helps buyers keep away from the complexities and short-term volatility of the market, specializing in regular progress over time. To maintain issues extremely easy initially, begin with an index fund that follows the broad market, such because the S&P 500, which has averaged round an 11% return since its inception in 1923.

4. Purchase a Web site

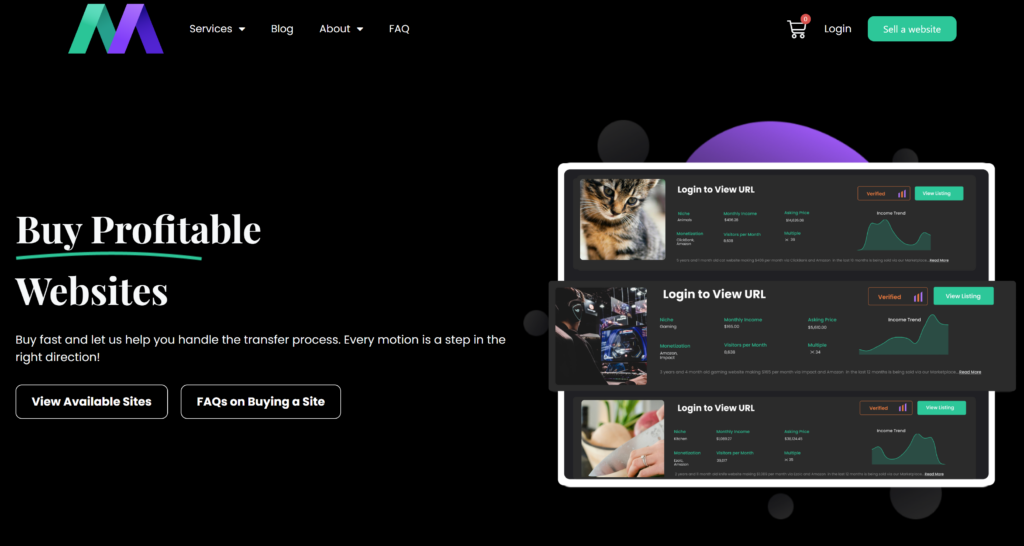

Investing in a web site is a quick observe to proudly owning a enterprise that already makes cash. Platforms like MotionInvest specialise in connecting entrepreneurs with on-line companies which can be prepared for a brand new proprietor. They’re geared in the direction of reasonably priced websites, making them accessible to smaller buyers.

This is the gist of the way to discover the correct web site for acquisition:

- Discover Listings: Take a look at web sites on the market on web site marketplaces.

- Due Diligence: Analysis the location’s site visitors, income, and progress potential.

- Make an Provide: If a web site matches your targets and price range, make a purchase order provide.

- Transition: As soon as bought, switch the web site’s belongings to your identify.

This strategy offers small enterprise buyers fast entry into e-commerce, turning digital prowess into revenue. Shopping for web sites on the market includes understanding their worth, negotiating the worth, and managing the switch. Attempt to get a way of the enterprise’s previous efficiency and search for insights on potential progress.

5. Micro Investing Apps

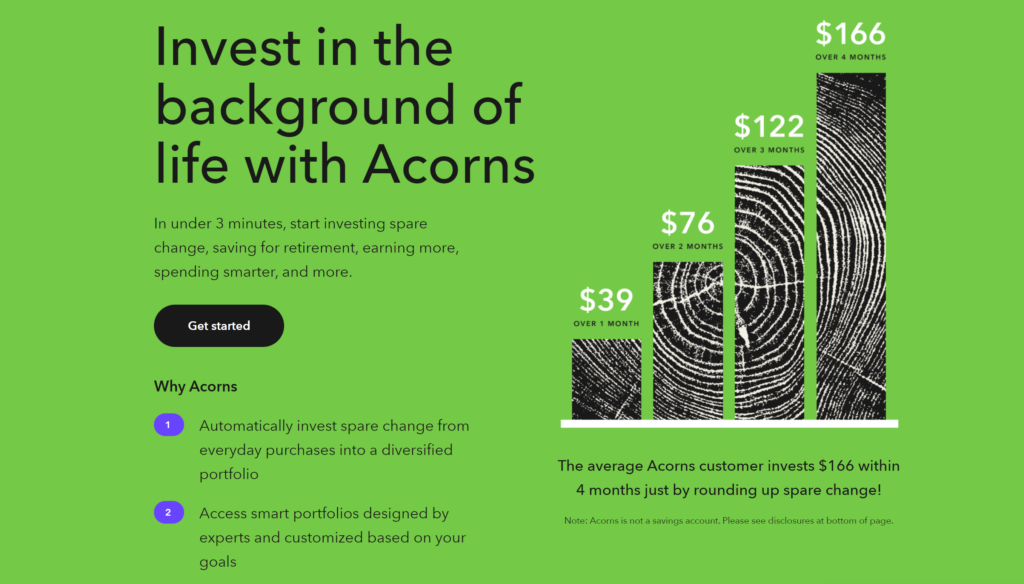

Micro-investing apps like Stash, Acorns, and Fundrise have revolutionized how small enterprise homeowners and entrepreneurs strategy investing.

Along with making small, versatile investments, you too can use cool options like round-ups and recurring investments for added earnings. This offers a gamification factor that conventional inventory and bond investing would not provide, making it simpler to maintain up with in the long run.

This is how micro-investing works:

- Begin with Small Quantities: Start investing with simply spare change or just a few {dollars}.

- Automated Diversification: Your investments are unfold throughout shares, bonds, or actual property.

- Easy Administration: Simply oversee your portfolio through the app, reducing out the monetary advisor.

- Academic Instruments: Study investing with assets supplied by the apps.

Micro-investing apps allow you to put money into a mixture of shares, bonds, and actual property via ETFs and REITs. They cater to diversified funding targets and danger tolerances. Whereas the potential returns are usually decrease than different strategies, micro-investing permits straightforward and accessible entry into the investing world. It is an effective way for small enterprise homeowners to dip their toes within the water with out committing massive sums of cash.

6. Associate with Fellow Entrepreneurs

Entrepreneurial partnerships can provide savvy buyers a worthwhile solution to construct fairness and money stream. You may wish to discover entrepreneurs in complementary industries or markets you understand properly who can deliver completely different abilities and connections.

Think about teaming up with a tech-savvy pal to create a digital advertising and marketing company. You deliver your gross sales experience to the desk whereas your pal handles the technical website positioning and web site optimization.

You every make investments time and monetary assets into launching the enterprise, planning to separate income as soon as the company is established.

To determine which partnership works greatest along with your funding targets, think about the next:

- Complementary Expertise: Search companions who deliver completely different abilities and experience.

- Shared Values: Ensure you have related values and work ethics.

- Communication: Set up clear communication channels and expectations from the beginning.

This strategy faucets into the unity of collaboration, providing enterprise homeowners a savvy solution to dive into small enterprise investing and enterprise capital. It is about leveraging collective strengths for mutual success, whether or not securing an fairness stake in a burgeoning startup or supporting a neighborhood small enterprise’s progress.

By partnering up, entrepreneurs can pursue bigger funding alternatives whereas minimizing private monetary publicity, all inside a framework that champions shared success.

7. Experiment with Angel Investing

Angel investing permits you to take part on a startup’s journey. You contribute cash to assist small companies or startups develop; you get a bit of the corporate in return. That is excellent for people who find themselves comfy with danger and wish to be extra concerned of their investments, aiming for large wins down the highway.

This is what you may take into accout when navigating your entry into angel investing:

- The place to Make investments: Deal with startups or native companies with a superb likelihood to increase. By placing your cash right here, you’re not simply serving to out; you’re setting your self up to make more cash if the enterprise takes off.

- Checking the Plan: It’s necessary to assessment the marketing strategy rigorously. A stable plan ought to present how the enterprise will earn money, perceive its market, and preserve observe of its money stream.

- Placing in Your Personal Cash: Not like shopping for shares, angel investing is all about utilizing your personal money. You’re betting that your assist will assist the enterprise develop and that you simply’ll see a pleasant return in your funding.

- Learn how to Discover Alternatives: Locations like credit score unions and crowdfunding platforms are nice for locating companies that want funding. They join folks with cash to small corporations that want monetary assist.

- Staying Secure: Be sure that there are clear guidelines about the way to assist the enterprise financially. This contains understanding the way you’ll get your a refund and what occurs if issues don’t go as deliberate.

- Being Concerned: Many angel buyers don’t simply cease at giving cash; in addition they provide recommendation or assist make massive choices to make sure their funding pays off.

Angel investing is thrilling as a result of you may assist startups develop and doubtlessly earn money. However keep in mind, it’s dangerous. Not each funding will likely be a winner, so it’s sensible to unfold your bets and actually perceive the companies you put money into.

Take a look at networks and marketplaces that join buyers to companies to search out the correct match.

AngelList connects buyers with startups, providing a platform to search out and put money into progressive corporations.

Learn how to Put money into Companies: Greatest Practices to Observe

In the event you’re beginning your funding journey, this is a quick information geared toward educating you on key concerns—serving to you navigate your funds with readability and confidence:

- Sketch Your Monetary Panorama: Earlier than diving in, take a second to map out your funds. How a lot are you able to comfortably make investments? What’s your timeline? Gauge your consolation with danger. This trio—price range, timeline, danger tolerance—is your compass within the funding world.

- Dive Deep into the Enterprise’s Soul: Look past the floor. An organization’s historical past, its place available in the market, and the way it’s been fueled financially can reveal the potential for triumphs and potential crimson flags or dangers.

- Negotiate with Perception: Deal with funding phrases as a dialogue, not a monologue. Scrutinize, query, and, when potential, form these phrases to reflect your targets. Clear, mutual understanding paves the best way for equity and avoids future tangles.

- Forecast Monetary Returns: Image the journey of your funding. Will it bear fruit via dividends, develop with curiosity, or respect in fairness? Anticipating the when and the way of returns crafts a clearer path on your monetary technique.

These steps might help you develop into a extra astute, educated investor and perceive the way to put money into companies by yourself phrases and necessities.

Is a Enterprise Funding Proper for Me?

Deciding whether or not to put money into a enterprise includes weighing the potential execs, cons, and dangers. Listed here are just a few self-assessment questions you may ask to find out if it is the correct time to discover ways to put money into companies:

- Do you’ve got expertise in operating or managing a enterprise?

- Are you able to afford to lose your funding with out impacting your monetary stability?

- Are you comfy with the opportunity of not seeing a return in your funding for a number of years?

- Do you’ve got the time and power to handle or oversee your funding actively?

In the event you really feel assured in your solutions and have a stable understanding of the enterprise you are investing in, then pursuing a enterprise funding will be the proper path for you.

The Backside Line: Do not Overlook About Sweat Fairness

After we speak about investing in a enterprise, it is not nearly placing in money or proudly owning part of the corporate. There’s one other tremendous necessary sort—sweat fairness. That is all about what you, the enterprise proprietor, deliver to the desk via your arduous work, time, and energy.

It is the way you be taught the ropes, achieve priceless expertise, and collect insights you may’t discover anyplace else. By rolling up your sleeves and diving into the work, you are constructing what you are promoting and boosting your worth and abilities.

So, do not underestimate this third type of fairness when studying the way to put money into companies. It could be probably the most precious one in every of all.