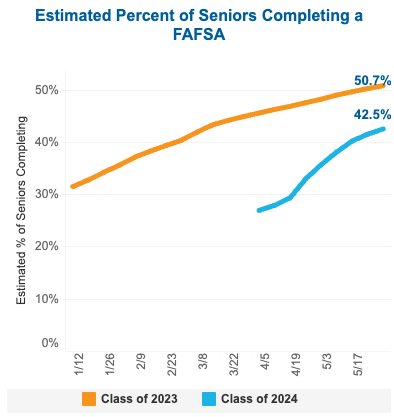

- Solely 42.5% of highschool seniors have competed the FAFSA, a lower of 14.4% in comparison with the prior yr

- Nevada, Florida, Utah, Arizona, and Alaska are the states with the bottom completion charges

- Decrease FAFSA completions signifies that fewer households will obtain need-based monetary support for faculty (and even attend faculty to being with)

Solely 42.5% of the highschool class of 2024 has accomplished the FAFSA as of Could 24, in response to the newest knowledge from the Nationwide School Attainment Community. That is 14.4% under the completion charge of the category of 2023 at this identical time final yr.

This enormous decline might be attributed to the Division of Schooling’s failed FAFSA rollout and steady delays even after it launched. The Division of Schooling has been pushing to extend FAFSA completions by way of numerous outreach initiatives, however as summer time approaches for seniors, FAFSA completions have plateaued.

NCAN FAFSA Tracker as of Could 24, 2024

Though many faculties have prolonged their monetary support deadlines, by not finishing the FAFSA, households are probably lacking out on monetary support – together with Pell Grants. Moreover, with out receiving monetary support, many specialists fear that faculty enrollment will decline as households determine they can not afford it.

FAFSA Delays And Botched Rollout

The FAFSA usually opens for completion in October, and households can being the monetary support course of effectively earlier than deciding on faculty enrollment (which occurs the next Could).

Nonetheless, this yr, the FAFSA opening was delayed till the final days of December, and processing was delayed all the best way till late-March (by way of Could). Even as soon as FAFSA submissions had been opened, households confronted problems with inaccurate knowledge requiring reprocessing, and a myriad of different errors.

The top result’s that households had been flying blind into faculty admissions season – probably having to make enrollment selections with out even realizing the price of faculty.

Associated: Most Costly Faculties In 2024

States With The Highest And Lowest Completion Charges

Primarily based on the newest knowledge from NCAN, listed below are the states with the best and lowest FAFSA completion charges:

Highest FAFSA Completion Charges

- Tennessee – 56%

- Louisiana – 53.8%

- Illinois – 53.2%

- Washington D.C. – 51.8%

- Texas – 51.3%

Lowest FAFSA Completion Charges:

- Alaska – 22%

- Utah – 27.4%

- Arizona – 29.2%

- Florida – 29.9%

- Nevada – 31.2%

What This Means For Households

Whereas the FAFSA submission deadline has handed for a lot of states and faculties, that does not imply you should not apply.

The FAFSA can unlock each federal Pell Grants and pupil loans, which might be beneficial choices for college kids to pay for faculty.

Moreover, some faculties should still be capable of award scholarship and grant cash for eligible college students. Nonetheless, they are going to want that FAFSA to validate monetary want.

Lastly, some advantage scholarships, regardless that they’re merit-based, require the FAFSA to be accomplished.

The underside line is that households ought to nonetheless fill out the FAFSA if they’re planning to attend faculty this fall.

Do not Miss These Different Tales: