The tax deadline is sort of right here! Listed below are some final minute tax reminders for those who’re nonetheless engaged on submitting your taxes.

Though it may not be essentially the most pleasant monetary job, it is a mandatory obligation that we every undertake yearly. And for those who use nice tax software program, submitting taxes doesn’t take as a lot time as it’s possible you’ll dread.

However tax submitting time isn’t solely about submitting returns. There are issues you are able to do in the present day that will help you get monetary savings in your tax invoice, and make it easier to save time on submitting.

Listed below are the most effective last-minute tax tricks to take into account this season.

Do not Miss The Tax Submitting Deadline

First, the tax submitting deadline goes to be later than “regular”. This 12 months, most filers face a Federal tax deadline of Monday, April fifteenth, 2024.

There are a couple of exceptions to this for those who stay in a catastrophe space this 12 months. Take a look at the IRS record of tax deadline extensions, and a fast abstract of them right here:

- Rhode Island impacted taxpayers can file till June seventeenth

- Maine impacted taxpayers can file till June seventeenth

- Michigan impacted taxpayers can file till June seventeenth

- San Diego, CA impacted taxpayers can file till June seventeenth

Most states that cost an revenue tax additionally require that the tax be paid by April fifteenth. Nevertheless, a couple of states have later submitting deadlines.

Double-Examine Your Return Earlier than You File

As you scramble to the tax end line, don’t rush by the vital particulars. A mistake in your tax type can result in main complications down the road.

Yearly, we learn tales about individuals who by chance mistyped their identify, tackle, or quantity. Whereas tax software program may also help spot apparent errors, it may well’t catch some errors like getting into the incorrect checking account info.

So don’t rush! Make sure that to file with the right Social Safety quantity and embrace all the mandatory signatures.

We additionally suggest reviewing totally different sections of your return to make sure you haven’t made a serious typo. For instance, one zero separates $8,000 and $80,000. If you happen to mistype one worth, you possibly can below or overstate your revenue, and one of these error may delay your tax return from being processed.

As you file your return, make the most of alternatives to evaluation your numbers. Double-check that they make sense together with your precise revenue. That is straightforward to do utilizing software program like H&R Block On-line which gives part summaries for revenue, deductions, and credit.

Make Positive You Have All Your Tax Types

Whereas most individuals settled into a brand new regular within the final 12 months, it’s nonetheless been remarkably tumultuous. You could have claimed unemployment, acquired state stimulus checks, had facet hustle revenue, or different “atypical” types of revenue. These are a couple of tax varieties you shouldn’t overlook this 12 months:

- 1099-G: Unemployment Earnings. 1099-G varieties present info on unemployment revenue (and whether or not taxes have been withheld from the revenue). Whereas employment numbers are at present sturdy, many individuals began 2021 unemployed, and they should declare that revenue. If you happen to didn’t obtain this kind, it’s possible you’ll must go to your state’s web site to learn the way to request an internet copy of the letter.

- 1099-NEC: Types reporting Non-Worker Earnings. The 1099-NEC reviews non-employment revenue. Filers with one of these revenue are thought-about self-employed, they usually could also be eligible for all types of self-employed deductions. If you happen to earned greater than $600 from a single enterprise entity, they’re supposed to offer a 1099-NEC to you.

If you happen to’re ready on late tax varieties, see this information.

File Your Taxes Even If You Owe

Even for those who owe cash in your taxes, you need to file your tax return on time. Curiosity on late taxes is an affordable rate of interest, however non-filing penalties are steep, and it will increase the speed you’ll pay on overdue taxes.

Getting your taxes filed can even make it easier to nail down how a lot cash you owe, so you may make a particular plan to get your again taxes paid off.

Search Out Respectable Deductions And Credit

Nice tax software program makes it straightforward to say authentic tax deductions and credit. Nice tax software program makes it straightforward to itemize deductions or declare deductions for scholar mortgage curiosity or charitable items.

It additionally helps you discover credit equivalent to:

Do not Neglect Your Self-Employment Bills

Whether or not you’re a full-time freelancer or a facet hustler, you doubtless have some type of self-employment revenue. And most types of self-employed revenue are accompanied by tax-deductible bills.

Earlier than you file, comb by your digital receipts to search out bills that depend as tax-deductible. Some frequent deductible bills embrace a portion of your web prices, web site upkeep prices, instructional supplies, and any direct prices of products offered. You is perhaps shocked on the sheer variety of tax-deductible bills to be present in your facet hustle.

Recording these prices lets you declare them in your tax return. H&R Block Self-Employed On-line explains a few of the authentic deductions, so you’ll be able to search for these bills in your previous bank card statements and different information.

In case your facet hustle is changing into a full-time hustle, you would possibly take into account getting skilled assist as nicely. H&R Block has tax consultants that may make it easier to with any state of affairs, from submitting your taxes this 12 months, to getting the assistance you should set your self up for fulfillment subsequent 12 months.

Declare Your Versatile Spending Account (FSA) Bills

Many employers provide Dependent Care Versatile Spending Accounts, Healthcare Versatile Spending Accounts, and different tax-deductible spending accounts. Cash in your Versatile Spending Accounts is yours, however it’s as much as you to say the cash in it. If you happen to don’t declare the cash by tax time, you’ll in all probability lose the cash in these accounts, even for those who put aside the cash your self.

If you happen to’re fortunate, you’ll have a couple of weeks remaining to spend the cash within the account. So top off on contacts, get your tooth cleaned, or do no matter you should do to make use of up that cash. Then submit your receipts, so you may get reimbursed.

Even for those who can’t maintain spending, you should still be eligible to submit receipts for reimbursement.

Each employer has totally different guidelines relating to the Versatile Spending Accounts, so examine together with your HR consultant to determine what you should do to make the most of these funds.

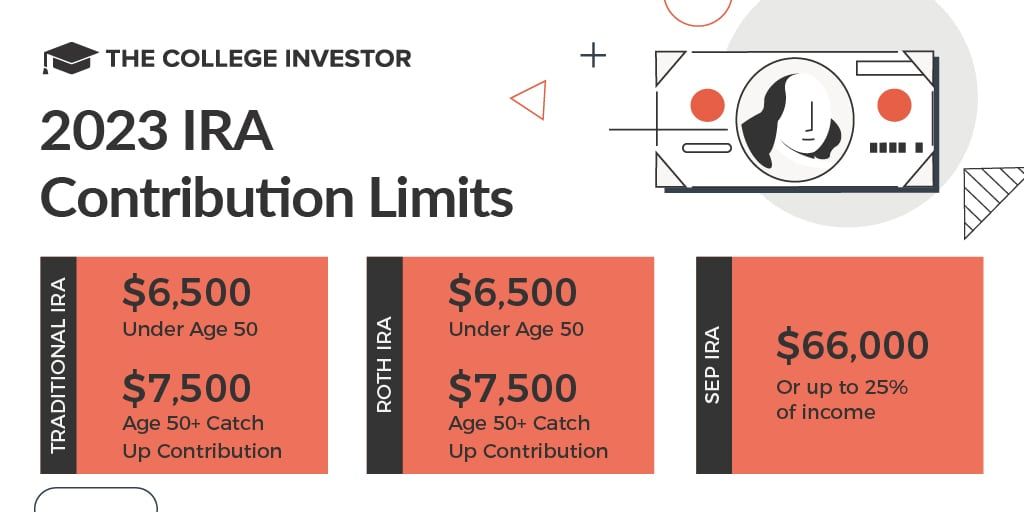

Contribute To An IRA Or Roth IRA

An Particular person Retirement Account (IRA) is a tax-advantaged funding account designed for retirement. Individuals who contribute to an IRA can declare a tax deduction this 12 months for funds contributed. The funds can develop tax-free till you withdraw them throughout retirement. There are revenue limits related to IRA contributions, and the utmost you’ll be able to contribute is $6,500 ($7,500 for folks age 50 and up). Contributions aren’t due till tax day, so this can be a nice solution to save in your taxes this 12 months.

Roth IRAs are just like conventional IRAs, however they don’t let you declare a tax deduction this 12 months. As a substitute, you pay taxes in your contribution this 12 months. Then the positive factors and distributions are free from taxation. Despite the fact that you don’t get a tax deduction, you will need to full your 2023 Roth IRA contributions by April fifteenth, 2024.

Word: You may also contribute to your HSA for 2023 all over April 15, 2024.

The Backside Line

As you progress towards the top of the tax submitting season, take into account benefiting from these last-minute tax ideas that may prevent cash. The ideas above may also help you for those who’re contemplating a DIY method to submitting your taxes. Nevertheless, generic ideas aren’t an alternative choice to assist from a tax skilled or tax submitting service. Professionals may also help you with tax prep and questions particular to your state of affairs.